![]()

Long term stability of

SSS funds behind PNoy’s veto of proposed pension hike

QUEZON CITY, Jan.15 -- It is the mandate of the government to ensure the

stability of the Social Security System (SSS) funds to pay for the benefits

of its members for long term, a Palace official said Thursday.

This was the statement of Presidential Communications Secretary Sonny Coloma

explaining President Aquino’s decision to veto the enrolled House Bill No.

5842, which provides for a two thousand pesos (P2,000) across-the-board

increase in the monthly pension of Social Security System (SSS) pensioners

and adjustment of the minimum monthly pension from P1,200 to P3,200, for

members who have contributed the equivalent of 10 credited years of service

(CYS), and from P2,400 to P4,000, for those with at least 20 CYS.

“Tungkulin ng pamahalaan na tiyakin ang katatagan ng pondo ng SSS upang

maseguro ang pagbayad ng benepisyo sa lahat ng miyembro nito,” Coloma said.

In his veto message, Aquino said, “While we recognize the objective of the

bill to promote the well-being of the country's private sector retirees, we

cannot support the bill in its present form because of its dire financial

consequence.”

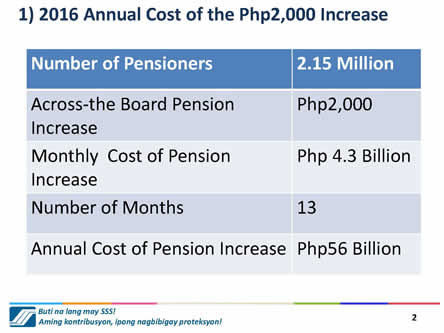

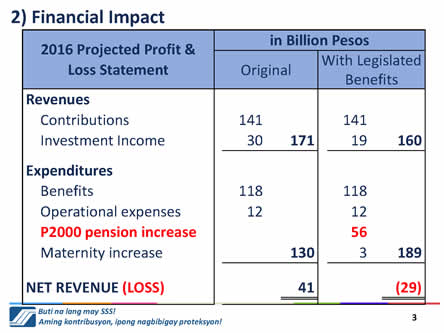

Citing SSS figures, Coloma said the P2,000 increase for the monthly pension

of 2.1 million pensioners will cost P56 billion every year; this amount is

greater than the annual income of SSS.

As a result, the funds for the pension benefit of the current 31 million SSS members will be used up by 2029, or thirteen years from now.

“Dapat isaalang-alang ang katatagan ng

pondo upang makamit ng lahat ng miyembro ang kanilang inaasahang pensyon

kapag sila ay nagretiro,” he added.

Based on the government’s review, if the pension hike will be approved,

contributions of all 31 million members should also increase from 11

percent to 15.8 percent, for SSS funds to be stable until 2042.

“Mula noong 1980, 21 beses na nagtaas o nagdagdag ng benepisyo ng SSS

samantalang dalawang (2) beses lamang itinaas ang kontribusyon ng mga

miyembro,” Coloma said. “Ang pinakahuling pagtaas ng kontribusyon ay

nasa antas na 0.7% lamang.”

He added that measure undertaken by the Aquino administration to improve

the stability of SSS will be all for naught should the P2,000 increase

in pension be implemented.

Some of the reforms in SSS were:

- Contribution surplus was achieved

from 2012 to 2015 compared to the contribution deficit from 2000 to

2011, due to the improved collection of funds for SSS operations.

- The total financial assets of SSS increased from P298 billion to P447 billion (50%), from 2010 to 2014, respectively. Net revenue also increased from the average P8 billion in 2000 to 2009, up to the average of P33 billion from 2010 to 2014.

These reforms extended SSS’ “fund life”

from originally 2039 to 2042.

“Kung nais nating higit pang maging matatag ang SSS, kailangang patuloy

na itaguyod ang tamang pamamahala na nasimulan noong 2010 hanggang

kasalukuyan,” Coloma said. (VDCG/RDA/PRC)

© 2016 PhilNews.com